des moines iowa sales tax rate 2019

Iowa has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. 954 rows Lowest sales tax 45 Highest sales tax 7 Iowa Sales Tax.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Groceries and prescription drugs are exempt from the Iowa sales tax.

. The December 2020 total local sales tax rate was. Fort Dodge IA Sales Tax Rate. Indianola IA Sales Tax Rate.

Dubuque IA Sales Tax Rate. In order to be eligible to bid at the Des Moines County Tax Sale all tax sale bidders must complete the. Keeping accurate records of all monies received and disbursed.

What is Iowa local option sales tax. Has impacted many state nexus laws and sales tax. The minimum combined 2022 sales tax rate for Des Moines Iowa is.

The Iowa IA state sales tax rate is currently 6 ranking 16th-highest in the US. While many other states allow counties and other localities to collect a local option sales tax Iowa does not permit local sales taxes to be collected. No sales tax or local option sales tax will be collected on sales of an article of clothing or footwear having a selling price less than 10000.

This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction. The County sales tax rate is.

The current state sales tax rate in Iowa IA is 6. Suite 100 Des Moines IA 50309. What is the sales tax rate in Des Moines Iowa.

Iowa has 893 special sales tax jurisdictions with local sales taxes in addition to the state. The average local rate is 097. The Iowa sales tax rate is currently.

Contact the Iowa Secretary of State by phone at 515 281. The Des Moines County sales tax rate is. Des Moines Iowa The Iowa Department of Revenue has announced the 2019 interest rate individual income tax brackets and standard deduction amounts for the 2019 tax year applicable for taxes due in 2020.

The new tax was approved by 70 percent of voters back in March and will generate roughly 37 million a year for property tax relief infrastructure upgrades public safety enhancements and neighborhood improvements. Des Moines which passed a penny sales tax in 2018 lowered its property tax rate by 60 cents in 2019. Des Moines IA Sales Tax Rate.

The Zestimate for this house is 263200 which has increased by 7700 in the last 30 days. What is the sales tax rate in Des Moines Iowa. 2020 rates included for use while preparing your income tax deduction.

Interest Rates The 2019 Department interest rate calculation is now final. Average Sales Tax With Local. 600 Is this data incorrect The Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax.

The latest sales tax rate for Des Moines IA. Known for its rolling plains and beautiful cornfields Iowa is home to an income tax system that ranges from one of the lowest income tax rates in the country at 033 to one of the highest at 853. This is the total of state county and city sales tax rates.

If a 1 local option tax applies divide by 107. The Iowa state sales tax rate is currently. To authorize imposition of a local sales and services tax in the City of Des Moines at the rate of one percent 1 to be effective July 1 2019.

The total tax rate might be as high as 8 depending on local municipalities. If only the state sales tax of 6 applies divide the gross receipts by 106 as shown in the example below. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

The Des Moines Sales Tax is collected by the merchant on all qualifying. There are a total of 832 local tax jurisdictions across the state collecting an average local tax of 0988. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7.

The 2018 United States Supreme Court decision in South Dakota v. The average combined tax rate is 697 ranking 27th in the. DES MOINES The new Local Options Sales and Service Tax will take effect Monday July 1.

The 2019 annual Tax Sale will be held by the Des Moines County Treasurer on Monday June 17 2019 in the. A retailer includes the 6 sales tax in the price of all goods and services. It contains 3 bedrooms and 2 bathrooms.

Iowa City IA. Remote sellers that meet these thresholds in the preceding year should begin collecting Iowa sales tax on January 1 2019. The city plans to cut its tax rate by 60 cents for the coming year.

This rate includes any state county city and local sales taxes. 605 24th St West Des Moines IA is a single family home that contains 1128 sq ft and was built in 1956. The tax system is made up of nine tax brackets which.

Statement of trade name on file with the Des Moines County Recorder. It will devote of half the money to reducing property taxes. The Des Moines sales tax rate is.

Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. Depending on local municipalities the total tax rate can be as high as 8. Local option tax is in addition to the state tax rate of 6.

The minimum combined 2022 sales tax rate for Des Moines County Iowa is. The Rent Zestimate for this home is 1474mo which has decreased by 24mo in the last 30 days. Rates include state county and city taxes.

The latest sales tax rates for cities in Iowa IA state. Des Moines expects to receive 37 million annually from the sales tax. Des Moines IA Sales Tax Rate.

The Iowa Department of Revenue will not seek to impose sales tax liability for periods prior to the effective date. In this example assume local option sales tax. This year the city plans to maintain its rate at 1661.

The current total local sales tax rate in Des Moines IA is 7000. The Iowa state sales tax rate is 6 and the average IA sales tax after local surtaxes is 678. The average local rate is 097.

Reynolds Wants To Keep It Simple On Corporate Tax Cuts And Says She S Optimistic About Negotiations Iowa Public Radio

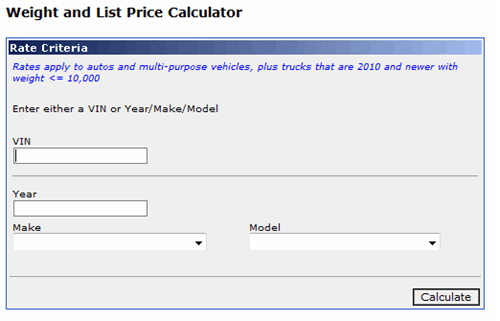

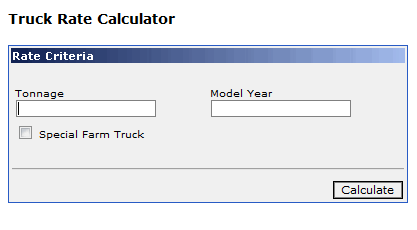

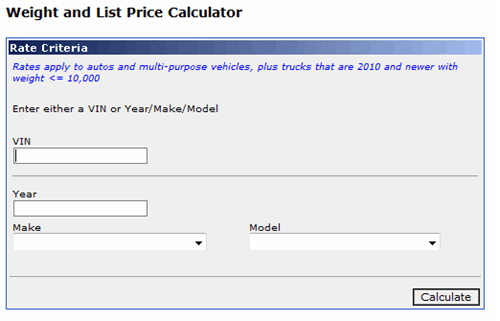

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Solved Revenue Gross Sales Less Sales Returns And Allow Chegg Com Cost Of Goods Sold Cost Of Goods Payroll Taxes

Washington Property Tax Calculator Smartasset

City Council To Conduct Public Hearing Monday On New Budget

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Keep Calm And List Your House With Me Sara Humenik Naperville Real Estate Agent Keller Williams Inf Real Estate Quotes Real Estate Humor Real Estate Slogans

State Conformity Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

State Conformity Tax Foundation

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Where Are Americans The Happiest Vivid Maps American History Timeline Map America Map