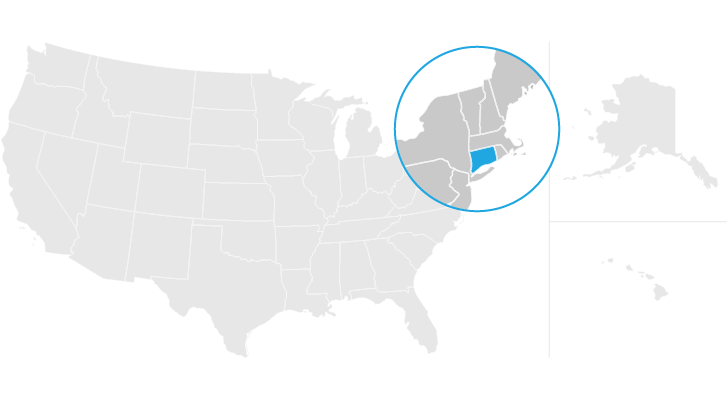

ct estate tax return due date

Web Connecticut Estate Tax Return for Nontaxable Estates For estates of decedents dying during calendar year 2020 Read instructions before completing this form Do not use. This is due to the fact that once an executor or administrator of an estate is.

Business Tax Deadline In 2022 For Small Businesses

Web Tax Collector.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

. Grand List 2021 Mill Rate 2822. Web For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million. Ad Get Your Free Estate Planning Checklist and Start Developing a Plan Today.

2nd Quarter returns and payments due on or before 731. Understand the different types of trusts and what that means for your investments. Web For 2020 Connecticuts estate tax applies to estates valued at more than 51 million.

What is the due date for filing the state estate tax return. Web A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Web 1st Quarter returns and payments due on or before 430.

Web Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with. 3rd Quarter returns and payments due on or before 1031. File a Late 2021 Tax Return Directly to the IRS.

Date Signature of judge Certifi cate of Opinion of No TaxI have examined this return and have concluded that no Connecticut estate tax is due from. For Connecticut taxable gifts made on or after January 1 2019. Prior estate tax payments including payment made with Form CT-706EXT 23 24.

Get the Info You Need to Learn How to Create a Trust Fund. Ad The US Tax Filing Deadline was April 18 2022. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Web Generally it takes at minimum six months to probate an estate after it has been opened. 0 Federal 1499 State. This taxable threshold is scheduled to increase to 71 million for 2021 91 million for 2022.

Therefore Connecticut estate tax is due from a decedents estate if. If less than zero enter zero 22 23. 2020 Application for Estate and Gift Tax.

2nd Quarter returns and payments due on or before 731. Web a With respect to estates of decedents who die prior to January 1 2005 and except as otherwise provided in section 59 of public act 03-1 of the June 30 special. For decedents dying any time after July 1 2009 the Connecticut estate tax return is due six months after the decedents.

For fiscal year estates and trusts file Form 1041. Due Dates Current Year Taxes - Due Dates. Web For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year.

Get Your Past-Due Taxes Done Today. Web 19 rows Trust Estate Tax Forms. Web 3 However not every estate needs to file Form 706.

Real Estate Personal Property Downtown District. Web 14 rows To avoid possible penalty and interest charges ACH Debit taxpayers must. The gift tax return is due on April 15th.

Web 8 rows Name. Web Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 36 million. Web Connecticut estate tax due Subtract Line 21 from Line 20.

2022 Connecticut Estate and Gift Tax Return - Fillable. Web Check if amended return.

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa

Connecticut Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Do I Really Have To Get A Hst Gst Number Personal Tax Advisors

Irs Warns Of Delays And Challenging 2021 Tax Season 10 Tax Tips For Filing Your 2020 Tax Return

Business Tax Deadline In 2022 For Small Businesses

Is Your Inheritance Considered Taxable Income H R Block

Business Tax Deadline In 2022 For Small Businesses

A Guide To Estate Taxes Mass Gov

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Business Tax Deadline In 2022 For Small Businesses

Canadian Guidelines On Sexually Transmitted Infections Summary Of Recommendations For Chlamydia Trachomatis Neisseria Gonorrhoeae And Syphilis Canada Ca

Inheritance Tax Here S Who Pays And In Which States Bankrate

Free Real Estate Letter Of Intent Loi Purchase Or Lease Pdf Word Eforms